yield extravaganza

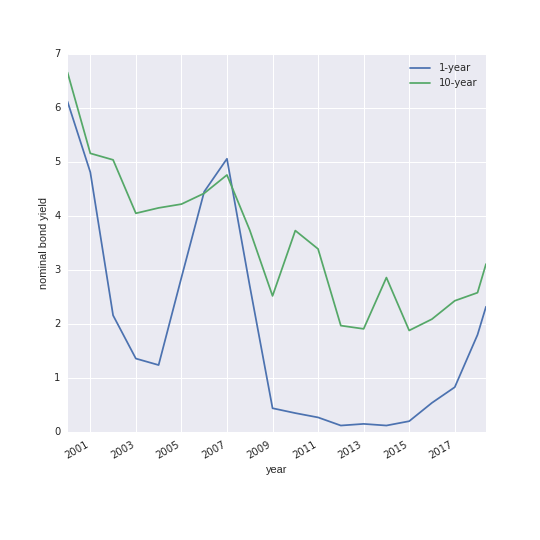

The 10-year Treasury yield hit a 7 year high recently. The nominal yield on a 1-year Treasury bond is also coming strong. Evidently, strong US economic data of late is convincing investors that the Fed will continue its hawkish approach. Thus the Fed will likely continue its “quantitative tightening” regime. The plot of the 1-year and 10-year Treasury nominals yields for the last couple decades below is interesting. It shows the rising recent trends, as well as the time before/during the last crisis when the yield curve inverted, followed by dramatic cutting of interest rates in the quantitative easing regime.

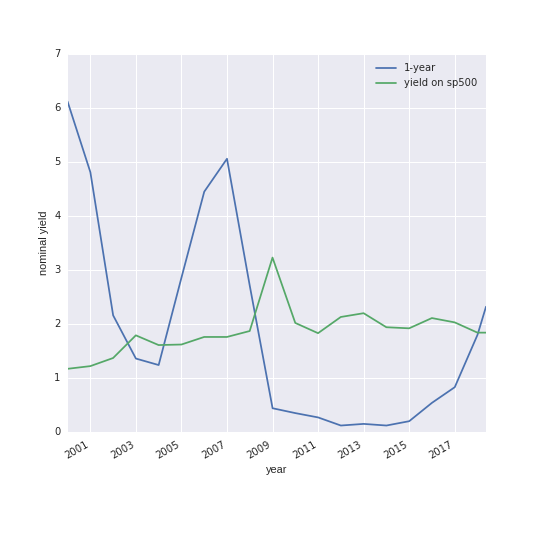

All things being equal, rising interest rates should make cash and the bond market more appealing to investors and pull money out of the stock market, says John Authers of the FT. Does this mean sky-high equity prices will come back to earth? Relatively short term yields in the bond market are now exceeding the average returns (from dividends) from equities in the S & P 500, again suggesting that money may flow out of the stock market. That being said, the last few earnings seasons have been good times across the board, which may keep equity valuations afloat because the economy is roaring along.